Customer Testimonials

To Understand Why We Are So Popular

To understand why Victorian Finance is so popular, it’s best to hear it from our customers themselves. We’ve built our national reputation one story – and home – at a time.

Home Loans

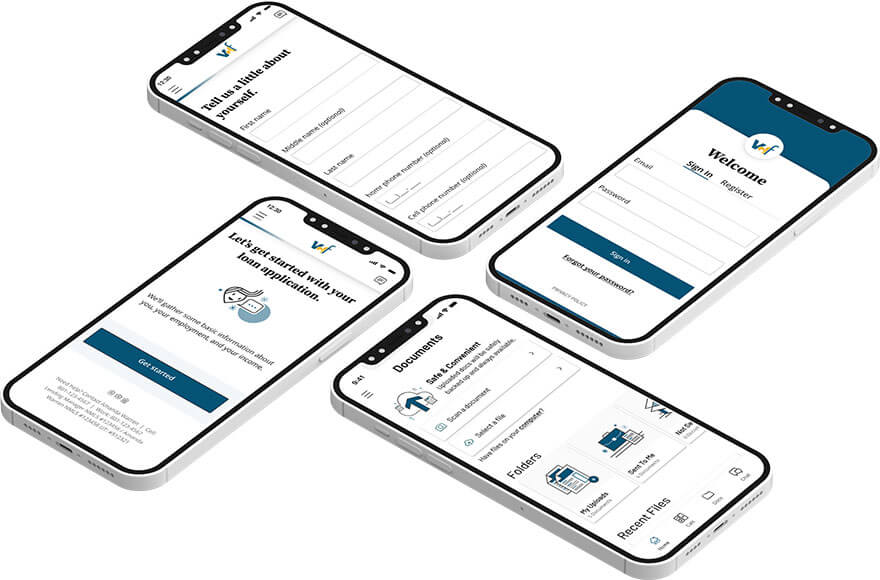

WE MAKE HOME LOANS EASIER

Providing you the most convenient technology with our mobile app!

Secure

Convenient

Simple

Your Mortgage. Made Easy.

We’re Here to Make the Loan Process Smooth Sailing

Top of the Line Secure and Easy to Use Technology

Team Centered Loan Process

Communication, how YOU want it

We Care About

Our Communities

Our Communities

Industry Accolades